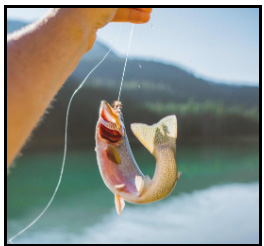

Get Off The Hook & Handle Your Outstanding Debt, The Right Way!

The amount that you initially borrow doesn’t always seem so bad, because, in a time of desperation, we tend to overlook the fine print and formalities of the agreement and repayment terms.

Let’s face it most of us do not even consider the amount of interest we will end up paying these companies who lent us the money, but that’s the catch, and you, my friend, got caught just like all of the other debt sufferers in the world.

I’m here to tell you it’s ok, you saw the bait, and you took a bite, but instead of feeling guilty and overwhelmed, let’s focus on how you are going to release yourself from this hook, so you can be free again.

So how do you get off the hook if you are already so far behind on repayment that it seems as if you’re never going to catch up?

Well, unfortunately, I have some bad news, but don’t worry, because I also have good news.

The bad news is that one way or another if you do not repay what you owe, unfortunately you will suffer the consequences. Either, you will continue to pay extremely high interest rates and fees, which can double, triple and even quadruple the original loan balance by the end of the term. Or you may choose to pay nothing back towards what you owe, but your credit will take a huge hit and you could still possibly get sued and garnished by your lender(s). Both of these options are a lose, lose situation.

The people that opt to continue to stretch out the loan over a long period of time by paying the minimum balances, will end up paying much more than they originally borrowed. I know it doesn’t seem fair, but remember that was the catch, and you did take the bait.

The people who decide to just pay nothing back at all, or maybe cannot pay anything based on their personal circumstances will take that major credit hit and will no longer be trusted by future lenders.

They may never be able to get approved for another credit card or payday loan, they may not even be considered when trying to buy a new home or new car, and if they do get lucky and are considered, the interest rate and payment options will be so high, that they will most likely end up failing to pay it back once again, fall even deeper into the abyss of debt and the cycle will be never-ending.

So what’s the good news you ask?

The good news is, there is a way to wiggle yourself off of that hook the right way so that you don’t have to suffer, by working with a professional debt resolution company like Encompass Recovery Group that handles debt settlement.

The term “debt settlement” seems so scary, but actually, it is a statement of relief. It literally means to settle one’s debt. The great part about this strategy is that you will end up paying less than what you owe. Yes I did say less than!

So you are probably thinking ok, well what’s the catch here?

The only catch here is one that you will actually get to benefit from because there are debt settlement companies out there that will help you get through this. The small fee to settle your debt is exponentially lower than what you would originally owe back to your lenders, and this fee is not collected upfront, meaning that you do not pay any fees until your debt is settled.

This route is a win-win!

So remember if you took the bait and got caught up in loan after loan and are unable to wiggle free, keep in mind that you don’t have to suffer anymore and your life does not have to be over, there are Debt Resolution companies out there that can help you settle all of your unsecured debt and help you to swim freely in a debt-free ocean once again.

Some reputable companies that have been around for many years that you can consider are: