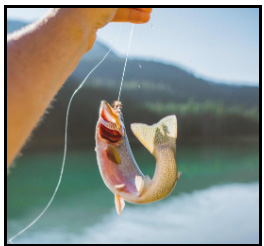

Borrowing money always has a catch!

The amount that you initially borrow doesn’t always seem so bad, because, in a time of desperation, we tend to overlook the fine print and formalities of the agreement and repayment terms.

Let’s face it, most of us do not even consider the amount of interest we will end up paying these companies who lent us the money, but that’s the catch, and you, my friend, got caught just like all of the other debt sufferers in the world.

I’m here to tell you it’s ok, you saw the bait, and you took a bite, but instead of feeling guilty and overwhelmed, let’s focus on how you are going to release yourself from this hook, so you can be free again.

So, how do you get off the hook if you are already so far behind on repayment that it seems as if you’re never going to catch up?

Well, unfortunately, I have some bad news, but don’t worry, because I also have good news.

The bad news is that one way or another, if you do not repay what you owe, unfortunately, you will suffer the consequences. Either you will continue to pay extremely high interest rates and fees, which can double, triple, and even quadruple the original loan balance by the end of the term. Or you may choose to pay nothing back towards what you owe, but your credit will take a huge hit, and you could still possibly get sued and garnished by your lender(s). Both of these options are a lose-lose situation.

The people who opt to continue to stretch out the loan over a long period of time by paying the minimum balance will end up paying much more than they originally borrowed. I know it doesn’t seem fair, but remember that was the catch, and you did take the bait.

The people who decide to just pay nothing back at all, or maybe cannot pay anything based on their personal circumstances, will take that major credit hit and will no longer be trusted by future lenders.

They may never be able to get approved for another credit card or payday loan, they may not even be considered when trying to buy a new home or new car, and if they do get lucky and are considered, the interest rate and payment options will be so high, that they will most likely end up failing to pay it back once again, fall even deeper into the abyss of debt and the cycle will be never-ending.

So What’s the Good News, You Ask?

The good news is, there is a way to wiggle yourself off of that hook the right way so that you don’t have to suffer, by working with a professional debt resolution company like Encompass Recovery Group that handles debt settlement.

The term “debt settlement” seems so scary, but actually, it is a statement of relief. It literally means to settle one’s debt. The great part about this strategy is that you will end up paying less than what you owe. Yes I did say less than!

Break Free from Debt with Encompass Recovery Group

If you’ve been caught in a cycle of loan after loan and feel like there’s no way out, you’re not alone, and you’re not out of options. With Encompass Recovery Group, you can settle your unsecured debt for far less than what you owe and finally regain control of your finances. There are no upfront fees, and you only pay once your debt is officially resolved. It’s a solution that truly works in your favor.

Don’t let debt define your future. Let us help you chart a path to lasting financial freedom.

Ready to get off the hook for good? Contact us today and start your journey toward a debt-free life.